[bit.do/azfiv] Rafi Amir-ud-Din and Asad Zaman “Failures of the ‘Invisible Hand’” Forum for Social Economics Vol. 45, Iss. 1, 2016 pp 41-60.

Textbooks, like Mankiw, state that the four claims listed below are at the center of modern economics. Our goal in this paper is to show that all four of these claims are wrong.

1. Participants in market economies are motivated by self-interest. (SI) – In fact, cooperation, service, recognition and status in community, and reciprocity are very strong motivators of human behavior.

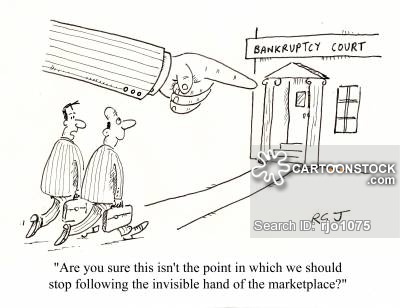

2. Decentralized market economies work very well, and maximize the welfare of society as a whole. (FM: free markets). As illustrated by the Global Financial Crisis, unregulated markets lead with regularity to disasters and crises.

3. The reason for excellent functioning of decentralized market economies is that all participants are motivated by self-interest. This self-interest works better than love and kindness in terms of promoting social welfare. (GG: greed is good). This is absolutely false, and the opposite of the truth – love and kindness work much better at promoting social welfare.

4. The principles listed above were summarized in the concept of the “Invisible Hand” by Adam Smith. (AS). Adam Smith can be blamed for many wrong ideas, but this is not one of them. In fact, free market economists attribute this theory to Adam Smith to create legitimacy for their ideas.

Detailed presentation of the paper is available in the following 1 hr. video.

To properly understand the theory of the “invisible hand” we must first accept the nature of most of mankind, which is dual in so far as we are both greedy and sharing, lazy and industrious. Man seeks to satisfy his needs with the least exertion yet these needs are unlimited. Economics covers both kinds of relationships. Yet in order to make sense of it, we need to avoid the intuitive and emotional parts and to carefully examine the logical and orderly ones. So what Adam Smith wrote about the invisible hand may not satisfy all of our ideal hopes for explaining how we behave, but it is still the best if not only means for getting to the true nature of the dual situation noted above. Do we have any other theory which better explains how our competitive and cooperative society is balanced?

The myths that are being taught in economics are due to the changed attitude that was introduced by John Bates Clark and his cohorts, when he spoiled Adam Smith’s 3 production factors and wrongly claimed that capital includes land. It does not land is not man-made whilst durable capital goods are. The way that capital in the form of durable goods changes in value over time, is very different to how useful land changes in value. There are many politically motivated claims in this subject and we need to look at the subject from a greater distance and with more objectivity. The science of macroeconomics was a pseudo one due to this attitude. My work “Consequential Macroeconomics–Rationalizing About how our Social System Works”. Write to me for a free e-copy and learn the mechanics of our man-made social system.

It is a wrong claim that Smith said that we don’t need love and kindness. He wrote about a system not about an individual and many of us as individuals are both loving and kind. This is the most significant difference between micro- and macro-economics and we need to look differently at the two. Smith was dealing with the macro effects and it is inaccurate to claim more than this.

If you will read the fourth item, you will see that “What Adam Smith wrote about the invisible hand” is not what modern textbooks tell us. The reality of what Adam Smith said is VERY DIFFERENT from what it is made out to be. There are many recent articles documenting this difference, which are referenced in my paper, cited and linked in the post above.

I’m sorry to be so dull and stubborn, but Smith’s concept of the effects of free-market competition having the result of a stability in prices and in steady rates of business as if being controlled remotely, is still a) what he wrote and b) true.

I realize that there are strong emotional factors here, but when you are objective and look at the “Big Picture” and not the individual one, it is still clear that Smith was correct. Please show me using direct words the effective difference between what Smith wrote (and meant) and what your modern textbooks claim he was explaining. I have not managed to find your claimed VERY DIFFERENT interpretation and that this matter is still unclear.

/Users/gavinkennedy/Desktop/Gavin Photo.jpg

Adam Smith did not have a ‘concept’ of ‘an invisible hand’. It was metaphoric. It bears no resemblance to modern interpretations/inventions of the invisible hand, directing its affects.

Smith’s was a simple point, so obvious that no political economist while Smith was alive and then right through to 1870-4 mentioned Smith’s use of an invisible hand.

Smith’s point was that by investing his capital in the local economy, the merchant added to GROSS domestic investment and employment. Simple! Trivial even. Rothschild called it Smith’s “joke”. I see what she meant.